One of the things I often think about is how best to manage my money — is it better to invest more towards short term, mid-term, or long-term goals like retirement? I try to have a balanced plan.

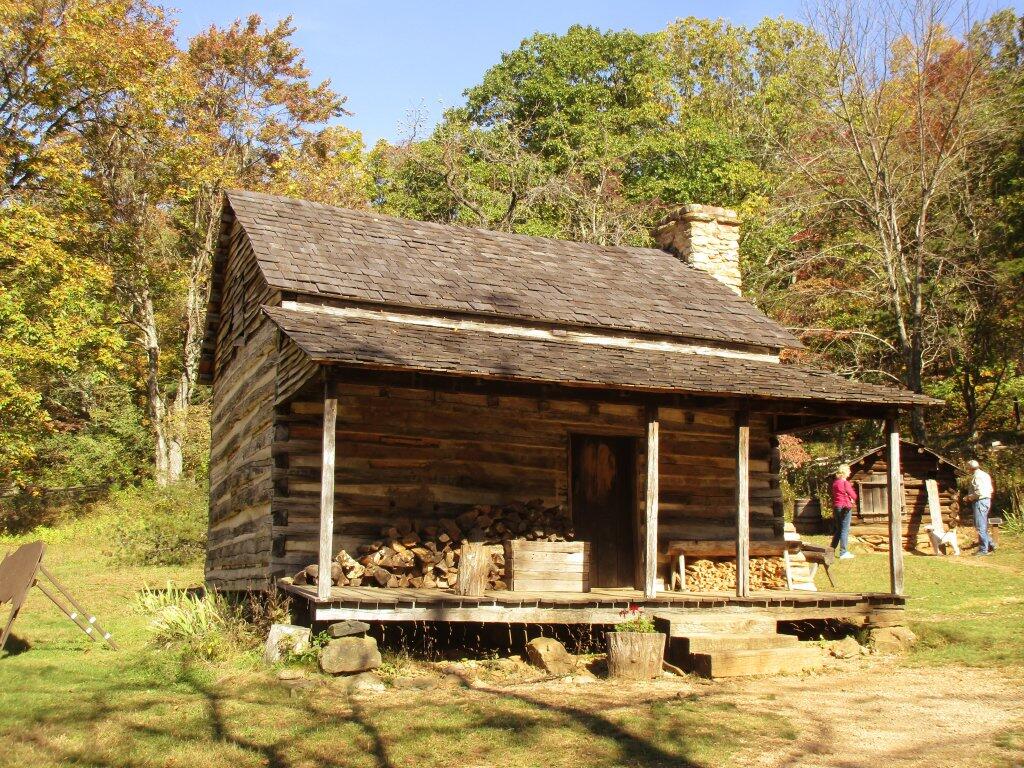

I’ve made it a priority to retire relatively young, or at least be in a place where I can live outside of a small town, where I can own land and an off-grid cabin, heat with wood, hunt and trap my own land, own more guns, have nice 4×4 truck, tractor and implements, a four-wheeler, burn my trash, hunt and hobby farm my land. Where I don’t have be stuck living the Albany, New York-life forever. I want to live where I can have my freedom to be my own person, protected from the evils of modern society.

All those things take a big chunk of cash, especially if I’m uninterested in getting a bank loan and want enough land that I can burn or shoot whatever I want without pissing off the neighbors. Land and being in the back woods is important to my future. I don’t mind working, but I don’t want to be tied to the big city for the rest of my life.

Short-Term: High-Interest Savings and Certificates of Deposit

For the short-term, I save each paycheck in various FDIC-insured accounts, in case of job loss, sickness, or injury — and more immediate needs not covered by the ordinary budget. I don’t ordinary touch this money, but sometimes there is something big I might want to get like a new toy, that’s not in my budget. But I’ve cut back a lot on expensive toys now, as I’m pretty happy with what I have now.

I realize within 5 years I will probably have to think about replacing Big Red, as it starts to wear out. I don’t drive the truck that much, but it is getting older at this point, and it’s tough with our salty climate.️ I’m also not sure how good the engine is — for a while it burned oil. I want to make sure I have a reliable vehicle, though I admit I will probably will go for something cheaper next like a 3/4 ton 4×4 regular-cab, long-bed work-truck. I probably would not lift my truck or get any kind of fancy features, although I’d probably get a cap with a rack to mount the solar panel. Or I might get a lower-cost sedan and do more tent camping. I don’t know, car prices have grown enormously over the past decade. So that’s going to take a pretty big hit on cash.

This money is taxed when I first earned it, and the interest earned is taxed on a yearly-basis like ordinary income, essentially increasing my income as far as the tax man is concerned.

Mid-Term: Low Cost Index Funds and Sector Funds

Each pay period I also make a payment to a nationally-known online brokerage firm to buy low-cost, low-free index funds and some sector funds. While the biggest chunk of money there is in total-market US and international funds, I also have some bond funds, some small and mid-caps high-growth/high-risk, and some energy industry sector funds which provide some protection against high energy prices.

I don’t plan to touch that money for another 10-20 years, which is between 2028-2038, as I want that money to continue to grow, and it’s heavily invested in things that gain value quickly but also have substantial downside risk, at least in the short-run. Another deep recession, like we had in 2008 could definitely set me back a few years on those investments, although in the past few years have seen substantial growth, so I’m not really worried even if we have a great depression the size of 90 years ago.

I don’t really need this money today or tomorrow, but I will want it when it comes to buying land and the off-grid cabin, and other related improvements. So I am more then willing to take short-term risk, which is somewhat mitigated by the fact that I practice cost-averaging by buying a little more each paycheck. Even if I buy high one year, and the market falls the next year, the next year it’s offset by the fact I am getting more shares at a lower price.

This money is taxed when I first earn it, and the tax man considers the dividends I reinvest into buying more shares, income each year. So I pay the tax man each year for the privilege of my total number of shares as they grow each year. Once I cash out these index funds to buy land and the cabin, I will have to pay long-term capital gain tax on the gains over the years. While paying long-term capital gain tax sucks, it’s less then if it was taxed as ordinary income. New York State taxes capital gains as ordinary income, so that’s yet another reason to leave New York when I’m at that point in my life.

The unfortunate truth, is when I need this money to buy land and the off-grid cabin, it will probably hit with a fairly big federal tax bill on the capital gains. In the point when I touch this money, my hope is already establish a residency in a state without no or at least low state capital gains tax. I probably would rent for at least a year in that future state, to avoid state taxes and give myself more time to look at properties I would ultimately want to buy.

Early Retirement: Deferred Compensation and Pension

I am hoping to retire around age 55 or so. A lot will depend on the affordability of healthcare and what options are available in the area where I buy my land. That would bring me to around year 2038, which sounds like a long-time away but it’s only 19 years. Assuming I get enough credit in with the state government, I will have 30 years in by age 55, and I will be able to sell part of my sick time for health insurance. I also am a vested member of state pension system, so there will hopefully be some money in that state constitutionally-protected benefit when I retire. Like social security, a pension is the part of the three-legged stool, but I don’t necessarily expect them to be all that strong in come years — although I have hope that our political leaders will make wise choices and strengthen both of these systems to ensure promised benefits are still part of our society by my retirement.

In support of this goal, I’ve been doing a pre-tax deferred compensation 457 plan, which allows me to reduce my gross income each year for tax purposes like with an ordinary IRA but at an amount up to $19,000 a year. Yeah, I don’t reach that number at this point. This is a good thing, especially for somebody like me who doesn’t have student loans or mortgage interest or local property tax deduction to use to reduce my total income. The catch if with the program you can only contribute a percentage of income earned by state or local government employment, it doesn’t count from other employers or sources. I have a second job, that is not covered by deferred compensation.

When you withdraw this amount you have to pay tax on the total amount it like it was ordinary income — you don’t get a break on capital gains like you do with other kinds of long-term capital gains. If I move out of New York State to a low-tax state without taxation on retirement savings, I will never pay any state income tax on this state income.

With 457 plans like deferred compensation, there is no age restrictions on when you can start taking money from it, although you are required to take a certain percentage of it starting by age 70.

Later in Retirement: Roth IRA

Early in my career, before I started in state service, I started contributing to a Roth IRA, over the years worked it up to maximum yearly contribution, which is now $6,000 a year. Money for Roth IRA is put in after tax-income, so you use money after payroll taxes to fund them. While limited, they have some definite advantages — namely they are very flexible in what you can put in them, tied to no one funding source like the 457 plans, and with the Roth IRA are tax-free to withdraw from after age 59, as long as you take a minimum distribution before age 70.

Another thing I like about the Roth IRA, is the contribution limit is relatively low at $6,000 so it’s a goal that can be fairly easily met each year by biweekly contributions. It is funded automatically, no matter if I am making money from my state work or private sector work. It just feels like an accomplishment to hit that number each year, and watch as it grows. I typically use target-based retirement funds, which are a low-cost mixture of index and bond funds.

I don’t plan to live a fancy life in my later years, but I will have to repair and replace equipment, and still have money for groceries, fuel and supplies. Even if I don’t have an expensive electricity or cable bill, my truck and toys will still need work. I will need groceries and supplies.

Savings and Investing is A Ways and Means

There is a lot of glamor on television about being rich. I doubt I will ever be too rich to chop my own wood, burn my own trash, or compost my own waste. I like doing things myself, and while there are some things I lack the skills to do, I’ve not one for living a life of luxury or excess. But I am working to save and invest, as a way and mean to a better future. Money buys essential land, property and services; it’s required for a better tomorrow. A dollar saved to today, is put away to grow towards a bigger dollar tomorrow. A buck might not seem like a lot today, but when you add a buck here and buck there, it adds up over a sufficient period of time. What seems like a distant future, it really only a matter of time until a better life tomorrow.