Rather then building all of these casinos in New York, wouldn’t it be a better policy to eliminate the long-term capital gains tax on middle class families? This way, if people had the urge to gamble, they could strategically invest in our economy, and if they invested in the right way, rather then gambling, could improve their economic situation.

Taxes

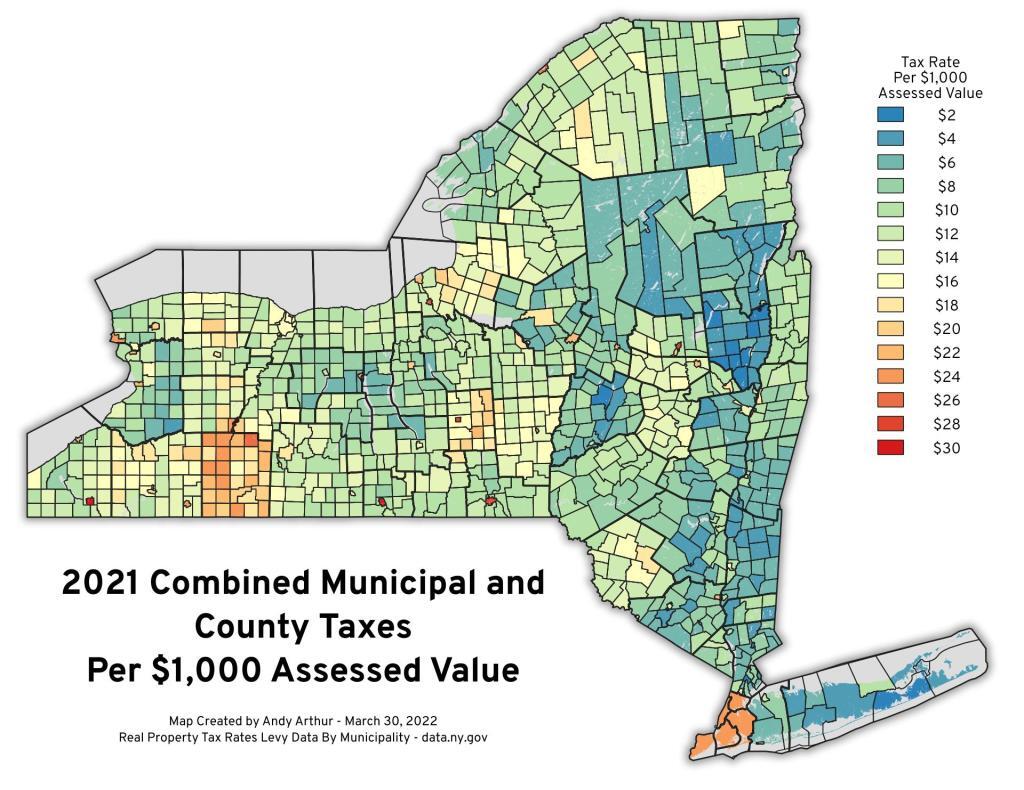

2021 Combined Municipal and County Taxes Per $1,000 Assessed Value

Allegany County is not a good value when it comes to county and local property taxes, with a county $13.17 per $1k assessment and many towns assessing an additional $10-12 per $1k. You might be able to score property cheaply there, but you'll pay some of the highest taxes in the state there on it.

You can get the data here: https://data.ny.gov/Government-Finance/Real-Property-Tax-Rates-Levy-Data-By-Municipality-/iq85-sdzs/data

You will need then to match it to SWIS code, which you can use this for: http://gis.ny.gov/gisdata/inventories/details.cfm?DSID=927

Shots – Health News : NPR

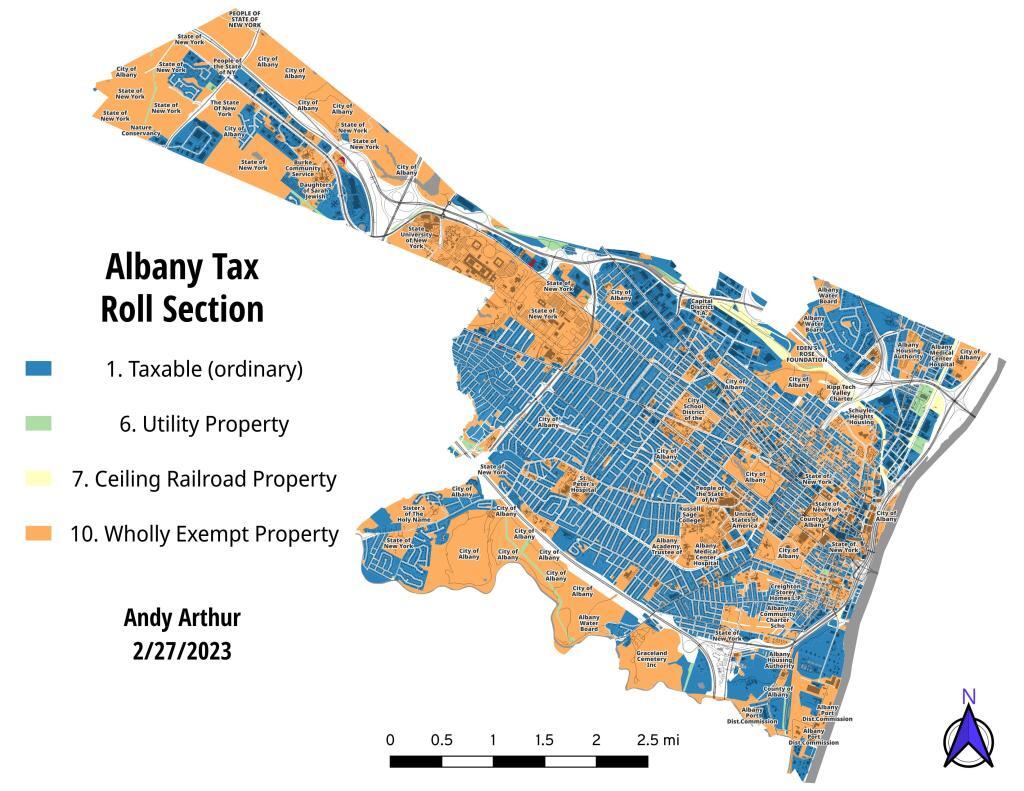

Albany Tax Roll Section (Tax Exempt Properties)

This map shows tax exempt properties in Albany in orange color, along with other properties that exist on other parts of the tax rolls.

How much taxes will be deducted from a 30-year old single filer who makes $50k?

NPR

The IRS is developing a system that would let taxpayers send electronic returns directly to the government for free, sidestepping commercial options such as TurboTax.

The agency plans a pilot test of the program next year.

Many other countries already offer taxpayers a government-run filing system. But the IRS plan is likely to face stiff opposition from the $14 billion tax-preparation industry.